Which Credit Score is Most Important for a Home Loan?

Among all other factors, the loan amount, interest rate, and tenor can be affected by credit score. For this reason, the importance of credit score for home loan should be kept in mind before applying. An applicant should try to apply for loans when their credit score is high and all outstanding debts are cleared.

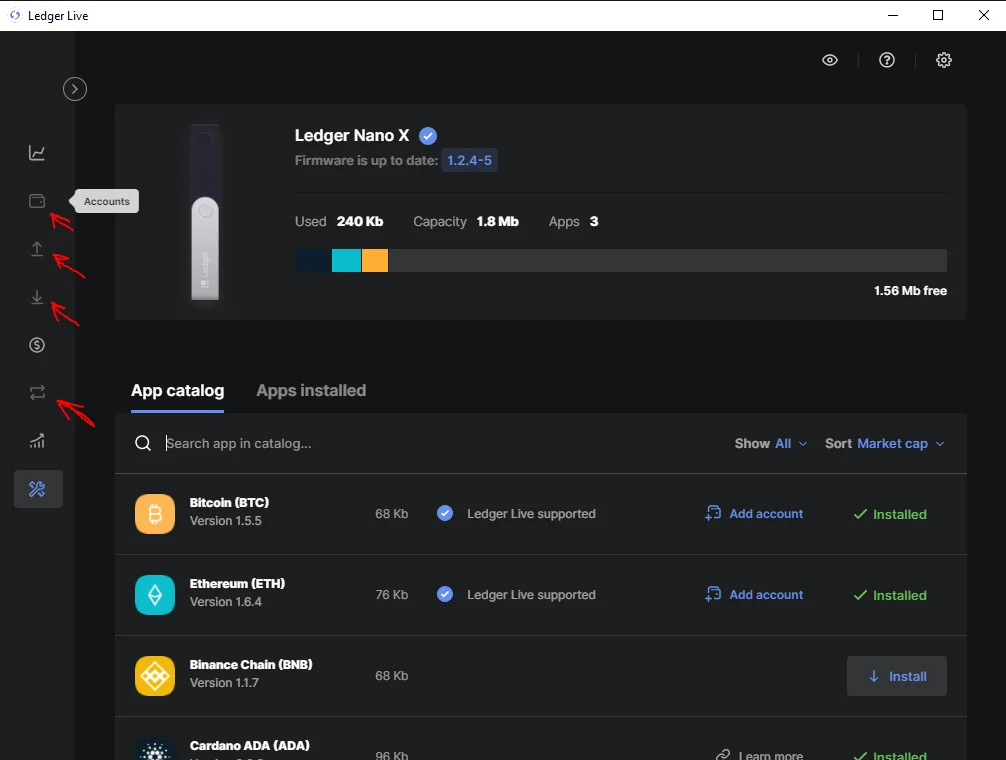

What is a good credit score required to get a home loan?

The ideal credit score that an applicant should maintain while applying for a housing loan is 750 or more.

Although the range of a credit score is between 300 and 900, maintaining a CIBIL above 600 is considered good. However, if it is below this number, then it is advisable to clear off all outstanding debts, before loan application.

What is the importance of a credit score to avail a home loan?

The importance of credit score for home loan availability is as follows:

- Avoiding loan rejection

A good credit score can help an applicant avail a loan instantly without facing rejection, as in such cases the risk is less for the lender.

- Better interest rates

Credit scores have a great influence on the interest rates on a home loan. A high credit score can help in availing loans at low interest rates.

- Longer repayment tenor

As a good credit score involves fewer risks with the lender while applying for a home loan, a borrower gets the advantage of flexible and longer repayment tenor.

- Flexibility in loan amounts

A borrower can even apply for a higher loan amount if applied with a higher CIBIL score. Moreover, with flexible tenor and interest rates, the repayment will also be smooth.

How to improve credit score?

The tips one should keep in mind while improving credit score or CIBIL score are as follows:

- Do not miss credit payments or make a late payment.

- Credit card bills should be settled completely and on time.

- Never apply for too many loans at one time

- Make sure to not use more than 50% of the available credit limit.

- There should always be a balance between unsecured and secured loans.

- Monitor credit reports and check credit scores at regular intervals.

- Check credit history of co-applicants in case of joint loan applications.

What are the assessment procedures for a home loan application?

The assessment procedures by which a home loan application is assessed are as follows:

- Credit history

The lending financial institution will check its borrower’s credit history, to ensure all debts have been paid off in time. Moreover, they may also check for any ongoing debts and its update.

- Current financial status

This method is usually followed by the lender to access the loan repayment capacity of the borrower. For this, the current income, saving tendencies, and spending habits of the borrower are analysed.

- Employment status and history

A borrower’s job security and stability are also determined by the lending financial institution before approving a loan application. This is checked through the information of how often they changed jobs.

How to increase the approval chances for a home loan?

The various ways of increasing a home loan approval chances are as follows:

- Start saving more

Before applying for a home loan, it is very important to start saving and prepare a good financial plan. This planning will not only help an applicant grab a home loan but also in avoiding a financial crisis.

- High CIBIL score

A good CIBIL score for home loan can increase its approval chances for a borrower. Therefore, it is recommended to clear all outstanding debts and increase the credit score before applying for a loan.

- Pay all outstanding debts

It is always advisable to pay the debts on time and make it a habit, especially before applying for a home loan. This is because the lending financial institution might check their borrower’s repayment habits and credit capacity before approving the loan.

Now that the importance of credit score for home loan is already discussed, it is time to plan finances accordingly and clear debts on time. This will eventually increase the score resulting in easy accumulation of home loans.

![Credit Score[headerImage] Credit Score](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgahjTnxzISbKpraKYPqLXVE9r59D4ePLhtIb9PPEVmr514aTGDGTELAre6LXqp5qV_w9Ck1S7dtMp5NnZVjY4RBGjMZqFOTzZRxAr6MFGi-D83WXDaVgmNeRE4jWTS509sZnfkOa4M5eqq4YAP7aYtcaHU__hPkWD6F0m1OU2v8y9N5Ng80Oj9PSb5/s16000/featured%20Image.jpg)